Simplicity Digital Advisor

How to Adapt and Financially Prepare for 2021

If we could look in a crystal ball, we would have a clear picture of how we should financially prepare for 2021. We can only guess what lies ahead for us next year basing on our experiences this year. 2020 has been tough on many- business closings, lay-offs, disruptions to learning, health and social concerns, and financial stress.

Holiday Savings Strategies 101: Plan and Execute

The holiday season is the time of year when personal expenses are likely to increase. Whether it may be travel expenses, events, or retail spending. Start preping your holiday savings strategies now. The 2020 holiday shopping season spend is expected to be substantial, but likely less than 2019’s Brick-and-mortar retail and e-commerce spending of $1.007 trillion. Today, holiday shoppers spend less time looking for gifts, but spend more money, especially when shopping online. On average, shoppers in 2019 distributed their holiday spend among the following:

- $596 on experiences

- $511 on gifts

- $389 on non-gifts

Fall Festivities and Socializing- Safely.

Socializing is critical for mental health, and people who associate with others live longer. Research also concludes that isolation can often lead to loneliness, depression, and other health problems. Especially now, during COVID-19, our desire to connect with others is heightened. Before the fall season changes to winter and cold weather arrives, get out and enjoy the season- but do so safely. Here is a list of ideas to safely enjoy fall festivities until we experience brighter days ahead in a post-COVID-19 world:

Why My Clients Choose to Work With Me

If you have had any previous experience with a financial advisor, chances are the conversation revolved around how much money you have, where it’s located, we can do a better job. It would seem that most investment firms share the same singular focus of trying to find better products that earn a higher rate of return which often takes more risk. For all of the fancy analytics and mathematical acrobatics available today, nobody has yet figured out how to predict the future. Earning higher returns is certainly not a bad thing, and something we can help you with as well, however, we believe we should help our clients avoid money they could be losing unnecessarily before considering options that require more risk. Return is not the only thing to consider when evaluating the efficiency of your own personal economic model.

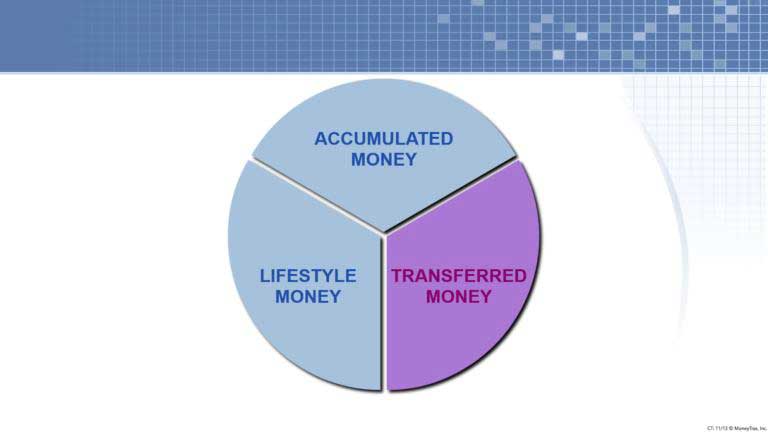

There are three types of money:

The money used to secure your financial future must somehow come from these three areas. Accumulated money represents the dollars you currently have invested and are currently saving. You could focus your attention on these dollars in order to find better investments that potentially pay higher rates of return.

Lifestyle money represents the dollars you are spending to maintain your current standard of living: where you live, what you eat, where you vacation etc. For many people, this is where the conversation ends. While everyone wants to solve their financial problems reducing their current standard of living is not a popular option. What if there were a way to address the issue without having to incur more risk or impact your present lifestyle? I’m glad you asked! Transferred money represents the dollars you may be transferring away unknowingly, and unnecessarily. Such as:

- How you pay for your house,

- What you pay in taxes

- How you fund your retirement accounts

- Non-deductible interest

- How you pay for major capital purchases like cars, education, weddings, and other large expenses.

There are really only two ways a financial advisor can be of help to you:

- By finding better products that pay higher rates of return requiring more risk

- By helping you be more efficient by avoiding unnecessary losses

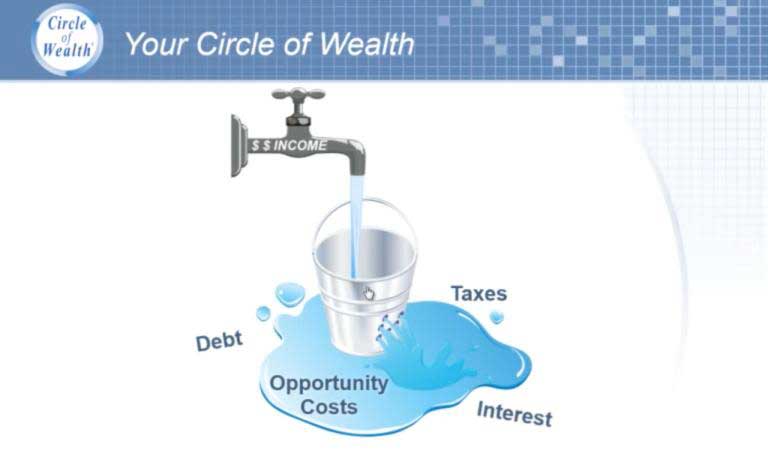

I believe that there is more opportunity to serve my clients by helping them first avoid the losses, before trying to pick the winners. My focus with clients begins with eliminating the involuntary and unnecessary wealth transfers. Consider this. There are two ways to fill up a bucket that has holes in it. One way is to pour more in, and the other is to first plug the holes, then the bucket will fill up even if the flow is just a trickle. Which strategy more closely resembles the way you are currently approaching financial management?

In addition, there are only two ways in which someone in the financial services business can help you expand your Circle of Wealth™. The first way would be to help you select better financial products offering perhaps higher rates of return, that often require you to assume more risk. The second way would be to help you become more efficient with your financial resources (savings, investments and cash flow spending). Solid Money Solutions specializes in performing the latter contact us today to get started.

The 2020 Election: Check Your Emotions and Stay Invested

November third is fast approaching, and you may be wondering how the 2020 Presidential election might impact your portfolio. Here is what we know from a historical perspective:

Now is the Time to Schedule Your Fall Financial Review

October is the financial planning month and a great time to meet with your financial professional to ask questions, review policy and portfolio performance, and make decisions that keep you on track with your goals. Regardless of your age, it may be a suitable time for you to schedule a financial review.

Lowering Interest Rates: Good for the Economy and the Markets?

Interest rates can positively or negatively affect the U.S. economy, the stock markets, and your investments. When the Fed changes the Federal Funds Rate (the rate at which banks can borrow money to lend to businesses or you), it creates a ripple effect. In this article we take a look at how lowering the interest rate can impact you.

What Does Wealth Mean to You?

When people think of wealth, they might think of examples in film, such as Veruca Salt from the 1971 classic Charlie & the Chocolate Factory. Little Veruca had everything she wanted in life but desired one of Willy Wonka’s geese that laid golden eggs. When Wonka refused to sell the little girl’s father one of his prized fowls, the girl broke into song about how she wanted everything… and ultimately labeled a “bad egg” and sent down the garbage shoot.

Life Insurance as Unique as You

Your life insurance needs are unique to your situation and can change over your lifetime. For some people, life insurance is to provide assets to raise a young family in the event of early death. Other people may use life insurance to cover their debt to ensure it is taken care of if they die prematurely. In business, life insurance could be a tool to transition ownership when the company sells or to insure a key employee whose death would profoundly affect the business.

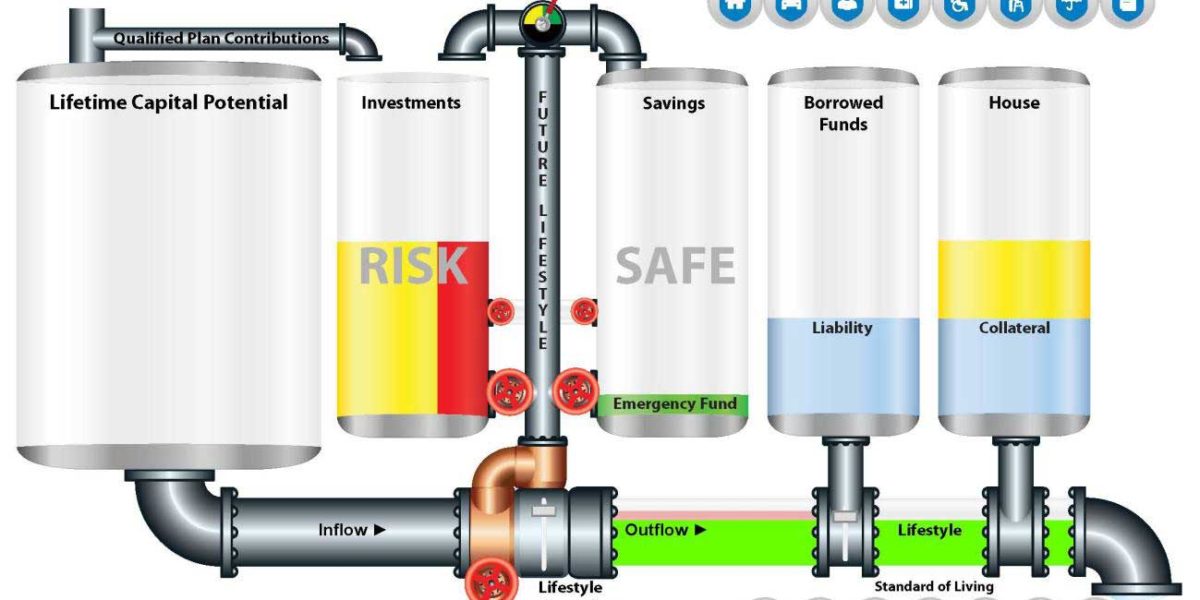

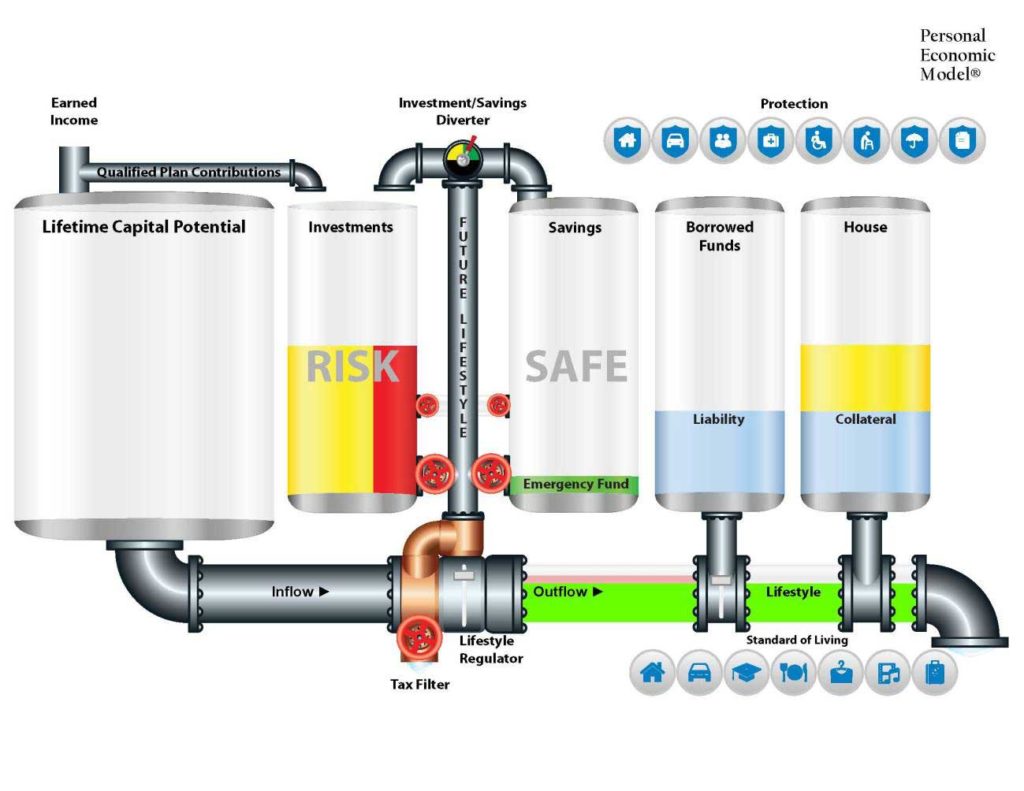

Your Personal Economic Model®

One of the tools we are able to utilize when discussing the best course of action to secure your financial future is known as the Personal Economic Model®. Much as a medical doctor would use an anatomical model to convey medical concepts, we use the following model to convey financial concepts.

This model offers a visual representation of the way money flows through your hands. On the left, you will notice the Lifetime Capital Potential tank which illustrates that the amount of money you will control during your lifetime is both large, as well as finite. Once earned your money flows directly to the Tax Filter where the state and federal governments extract tax dollars due from earnings on your monthly cash flow. The after-tax balance is then directed to either your Current Lifestyle or your Future Lifestyle determined by your management of the Lifestyle Regulator. Determining the balance of cash flow between your current lifestyle desires and your future lifestyle requirement may be the most important financial decision you will ever make.

Here’s why.

Each and every dollar that is allowed to flow through to your Current Lifestyle is consumed and gone forever. The goal is to accumulate enough money in the Savings and Investment tanks so that by the time you retire, the dollars in those tanks can then be used to satisfy your future lifestyle requirements. Position A would be to have enough in the tanks to live like you live today adjusted for inflation and have your money last at least to your life expectancy. That’s a win, but the icing on the cake would be to accomplish that with little to no impact on your present standard of living, and that is exactly what we strive to help our clients to do.

In working together, we can help you to address the following:

- Optimize the balance between your Current and Future Lifestyles

- Improve efficiency in your current personal economic model

- Design, implement and execute a plan to secure your financial future

- Limit the impact on your Current Lifestyle dollars (maintain your current standard of living)

In addition, there are only two ways in which someone in the financial services business can help you expand your Circle of Wealth™. The first way would be to help you select better financial products offering perhaps higher rates of return, that often require you to assume more risk. The second way would be to help you become more efficient with your financial resources (savings, investments and cash flow spending). Solid Money Solutions specializes in performing the latter contact us today to get started.