News and Financial Insights

Your Personal Economic Model®

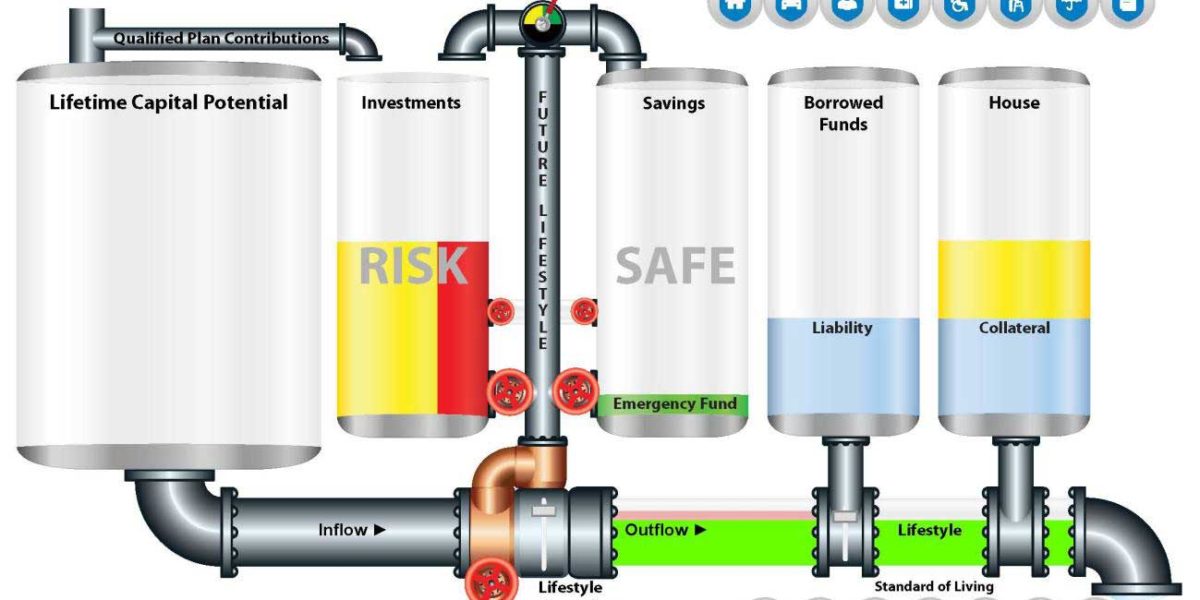

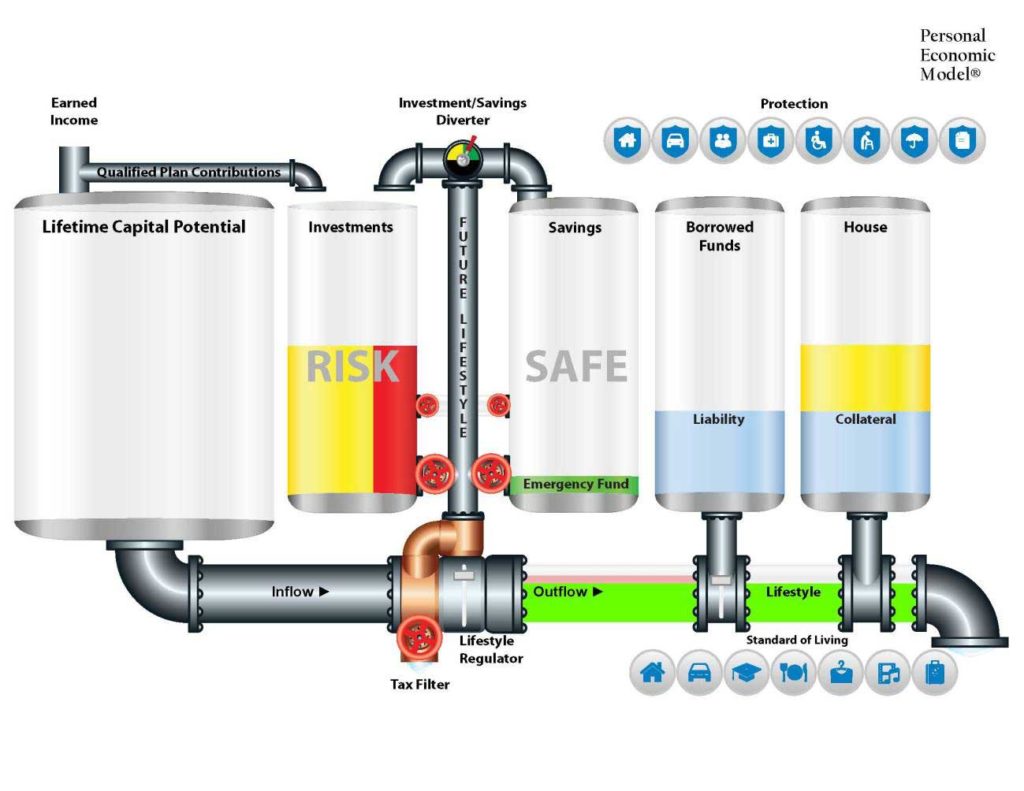

One of the tools we are able to utilize when discussing the best course of action to secure your financial future is known as the Personal Economic Model®. Much as a medical doctor would use an anatomical model to convey medical concepts, we use the following model to convey financial concepts.

This model offers a visual representation of the way money flows through your hands. On the left, you will notice the Lifetime Capital Potential tank which illustrates that the amount of money you will control during your lifetime is both large, as well as finite. Once earned your money flows directly to the Tax Filter where the state and federal governments extract tax dollars due from earnings on your monthly cash flow. The after-tax balance is then directed to either your Current Lifestyle or your Future Lifestyle determined by your management of the Lifestyle Regulator. Determining the balance of cash flow between your current lifestyle desires and your future lifestyle requirement may be the most important financial decision you will ever make.

Here’s why.

Each and every dollar that is allowed to flow through to your Current Lifestyle is consumed and gone forever. The goal is to accumulate enough money in the Savings and Investment tanks so that by the time you retire, the dollars in those tanks can then be used to satisfy your future lifestyle requirements. Position A would be to have enough in the tanks to live like you live today adjusted for inflation and have your money last at least to your life expectancy. That’s a win, but the icing on the cake would be to accomplish that with little to no impact on your present standard of living, and that is exactly what we strive to help our clients to do.

In working together, we can help you to address the following:

- Optimize the balance between your Current and Future Lifestyles

- Improve efficiency in your current personal economic model

- Design, implement and execute a plan to secure your financial future

- Limit the impact on your Current Lifestyle dollars (maintain your current standard of living)

In addition, there are only two ways in which someone in the financial services business can help you expand your Circle of Wealth™. The first way would be to help you select better financial products offering perhaps higher rates of return, that often require you to assume more risk. The second way would be to help you become more efficient with your financial resources (savings, investments and cash flow spending). Solid Money Solutions specializes in performing the latter contact us today to get started.

Reg BI: What Is It, and Why Should You Care?

On June 30, 2020, Regulation Best Interest, or Reg BI for short, officially went into effect. But what is Reg BI, exactly? Where did it come from, and how does it impact you, the investor? Here’s what to know about the new rule under the Securities and Exchange Commission (SEC).

The CARES Act and RMD: Relief for Investors

The CARES Act (The Coronavirus Aid, Relief, and Economic Security Act) contains the legislation for Required Minimum Distributions (RMD) for those over age 70 ½ and have already started RMD. Under the CARES Act, no RMD is required for individuals or beneficiaries of inherited retirement accounts in 2020 due to COVID-19. How will this help investors?

Relationships are Fundamental

It’s a funny thing about advice. Everyone seems to have an overabundance of knowing what others should do, and they have no problem telling you about it, especially when the monetary gain is a motivating factor. However, there also seems to be an equal dearth of understanding about who such advice is given to. If you’re anything like us, we do not believe that advice for a “target market” is also solid advice for an individual whether they can be classified as a part of a specific target market or not. Everyone is unique and different individuals and with regard to their financial lives, but also in the way they make decisions about their finances as well. We feel that it is prudent to first understand our clients, their individual situations, and what motivates their decisions before offering advice of any kind. This provides a framework within which to begin helping our clients answer the four toughest financial questions they will face.

- What rate of return do you have to earn on your savings and investment dollars to be able to retire at your current standard of living and have your money last through your life expectancy

- How much do you need to save on a monthly or annual basis to be able to retire at your current standard of living and your money lasts till life expectancy?

- Doing what you are currently doing, how long will you have to work to be able to retire and live your current lifestyle till life expectancy?

- If you don’t do anything different than you are doing today, how much will you have to reduce your standard of living at retirement for your money to last to your life expectancy?

The answers to these questions can be given in our first ten minutes together, and they will give you an indication of where you find yourself currently with regard to securing your financial future. Our specialty is rooted in helping folks to improve their current financial position, preferably without impacting their current lifestyle, Our clients can often solve the issues uncovered in the above four questions by focusing first on dollars one could be losing unknowingly and unnecessarily without taking on additional financial risk.

We begin with the seemingly outlandish premise that a solid relationship should be the foundational starting point.

Why Does Gross Domestic Product (GDP) Matter?

When looking to protect your financial future in today’s COVID-19 environment, it’s essential to understand how the economy functions on a historical basis as it relates to the country’s GDP (Gross Domestic Product) and the stock market.

U.S. Unemployment: Problems for the Economy?

The U.S. unemployment rate is the percentage of unemployed workers in the total labor force and indicates the health of the U.S. economy. COVID-19 has significantly impacted unemployment to record numbers not previously seen since the government began tracking the data in 1939. COVID-19 has surpassed The Great Depression in the amount of unemployed and the economic fallout to businesses and workers.

Restarting the U.S. Economy: What is The Fed Doing?

When the U.S. economy is stagnant, the U.S. Government uses fiscal and monetary tools to stimulate the U.S. economy. However, with our economy facing multiple problems, that may not be an ‘easy fix’ in comparison to past recessions. COVID-19, social unrest, permanent business closings, and an upside-down GDP may prove to be difficult problems to overcome in the near term.

Travel Plans Cancelled? Buy Local and Travel Local.

COVID-19 has changed the way that Americans shop and travel, impacting our spending habits indefinitely. With stores, hotels, and restaurants closed or at limited capacity, many choose to stay at home and purchase online or locally, helping to support their local small businesses. The positive impact of working from home, virtual meetings, and happy hours, on-line fitness classes, and being at home is that our consumption habits have changed. Read hear to learn why you should buy local and travel local.

Inflation and Taxes Risk: Protecting Your Financial Future

As areas of the U.S. start to lift COVID-19 restrictions, Americans are starting to see the impact of increasing prices at the supermarket and the start of inflation. Here is the recommended steps toward protecting your financial future. While the CARES Act provided a one-time payment to individuals and for business stimulus, it will not solve our future economic problems since government action always comes with a price.

Sequence of Returns Risk: Impacting Your Retirement Portfolio

The sequence of returns impacts investors when they are either adding to or withdrawing money from their retirement portfolio, which can create risk depending on the sequence and the market conditions at the time. If an investor is not doing either, then there is no sequence of returns risk.